Conversational AI and Analytics solutions empower financial institutions to deliver a vast range of self-service capabilities and exceptional customer experiences while ensuring full compliance with industry regulations.

Conversational AI deployed on websites or IVR channels can solve 1 out of 4 customer inquiries without the need of live agents.

Voice Biometrics can authorize customers using their voice and decrease the duration of authorization-required calls by 10%.

Interaction analytics can help improve customer experience by 25% via presenting actionable insights for decision-makers.

Our enterprise-level Knovvu Virtual Agent solution is supported by over 90% intent recognition accuracy and GenAI features. This represents a hybrid approach that financial institutions can trust for automation when serving customers 24/7.

Discover Knovvu Virtual Agent

Knovvu Analytics solution monitors and analyzes all customer interactions and ensures full compliance with every customer service channel, both voice and text. Our market-leading 97% speech recognition accuracy represents the backbone for this product.

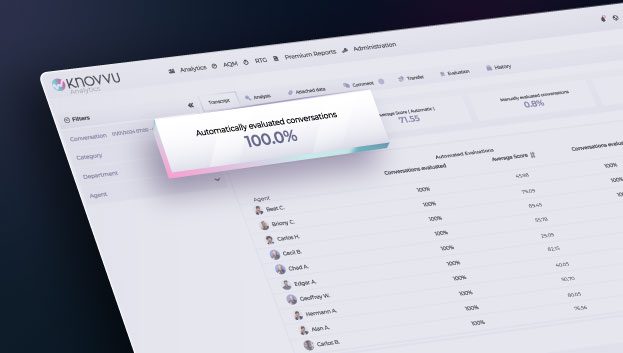

Discover Knovvu AnalyticsMonitor 100% of agent interactions, evaluate performance with objectiveness and provide them with actionable feedback with our Knovvu AQM product. Assist agents in real time before misunderstandings or lack of information turn into frustrated customers and longer AHTs.

Discover Knovvu AQM

Conversational AI, Analytics, and Voice Biometrics technologies can be used to increase automation and personalization while helping to reduce the cost of serving customers for financial institutions.

Voice biometrics and real-time guidance solutions can help agents identify customers with confidence and serve them seamlessly.

Conversational analytics, powered by AI, presents insights into the customer's main reason for contact. This enables effective interactions regardless of service channel.

AI-augmented agents have access to the right information at the right time, while speech recognition tech ensures full regulatory compliance.

Let’s go into detail on how Knovvu’s conversational solutions can improve your agent and customer experience.